fsa health care plan

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. The spending plan includes roughly 11 billion from.

Flexible Spending Accounts How An Fsa Works Optum Financial Plans

LEGAL NOTICE Privacy Policy Privacy Policy.

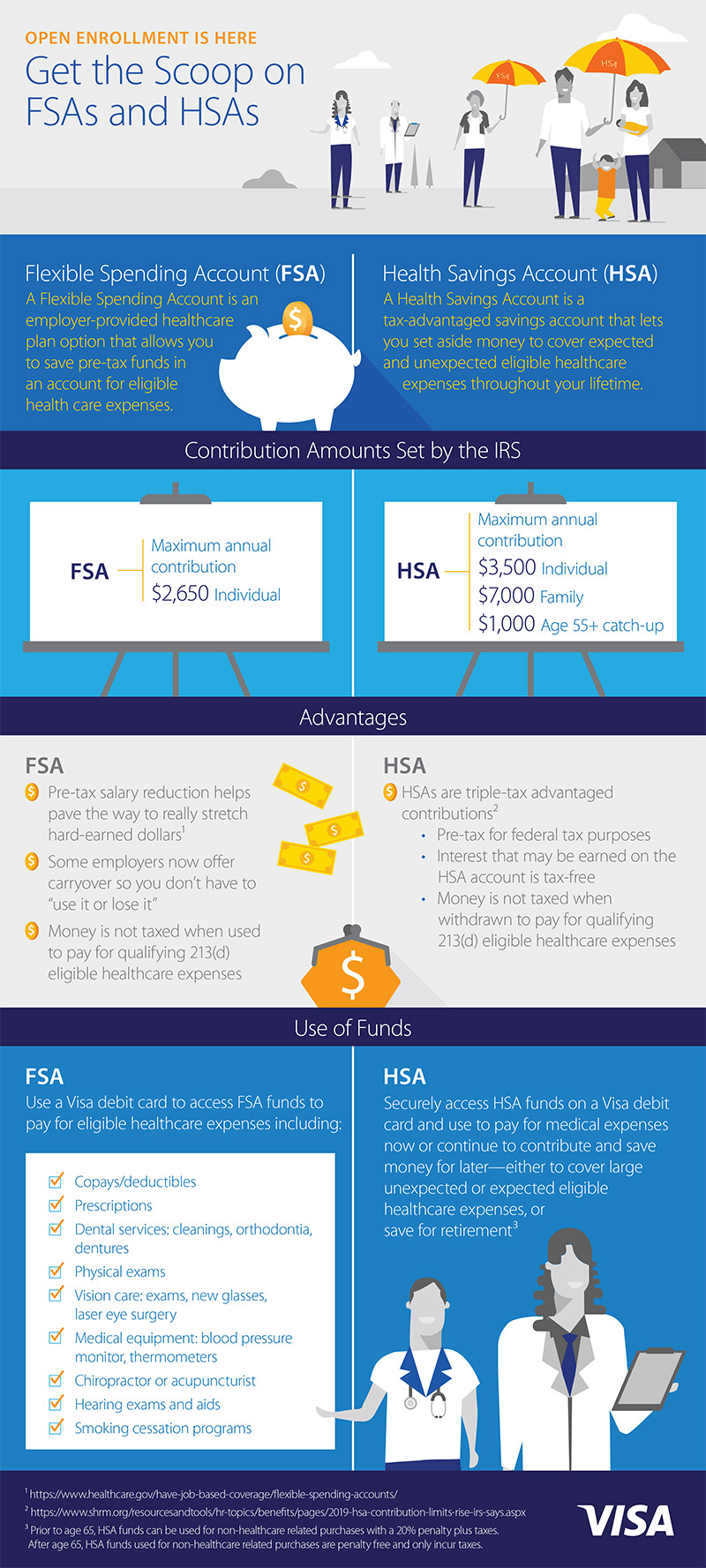

. You may use these funds to pay for eligible. A flexible spending account or FSA is a tax-advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. ALL ABOUT HEALTH CARE FSAs Choose and save Choose how you spend the money You have options with a health care FSA.

It helps you save on everyday items like contact lenses. 800 675-6110 TTYTDD 800 431-0964. A Health Care Flexible Spending Account FSA allows you to set aside tax-free dollars each year for health care expenses not covered by insurance.

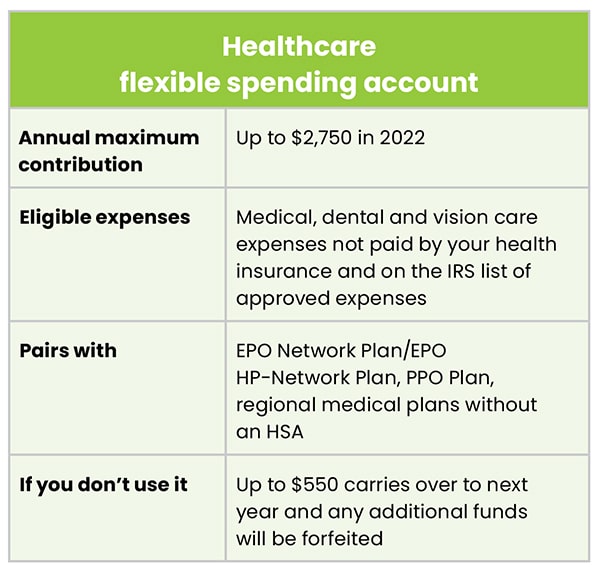

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. 2022 - Delta Health Systems. You can contribute up to 2750 in 2021 and 2850 in 2022 into your Healthcare FSA.

Care CoveredDirect Member Services 1-855-270-2327 TTY 711 24 hours a day. 1-844-854-7272 TTY 711 24 hours a day. 3 hours agoRetention Payments for Certain Health Care Workers.

Annual contribution limits. Department of Health Care Services. You can use your FSA to.

This means youll save an amount equal to the taxes. Retention Payments for Workers in Certain Health Care Facilities. Medicare is the federal government program that provides health care coverage health insurance if you are 65 under 65 and receiving Social Security Disability Insurance SSDI for.

FSAs work on a use it or lose it basis meaning any funds not spent by the end of your plan year will be lost unless the plan has a grace period or rollover feature. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses that are not covered by your health care plan or elsewhere. For example if your employer put in 300 and you decided to contribute 600 you have 900 to.

If you need mental health urgent care call your county Mental Health Plan at 1-800-854-7771 or LA. Depending on the extent of your. In the 1970s health reimbursement accounts HRAs were created to help offset rising health care costs.

Care Member Services at 1-888-839-9909 TTYTDD 711. When you have a health or limited-purpose FSA the total amount is available on the first day. A Healthcare Flexible Spending Account FSA is a personal expense account that works with an employers health plan allowing employees to set aside a portion of their salary pre-tax to pay.

Care Health Plan is an independent public agency created by the state of California to provide health coverage to low-income Los Angeles County residents. Established in 1997 LA. If youre married and both you and your spouse have an FSA.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Cigna offers 3 different types of. Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals spouse.

What is an FSA. Flexible spending accounts FSAs for medical expenses part of a. Health Net Community Solutions Inc.

The 2750 contribution limit applies on an employee-by-employee basis. You may call your county. Flexible Spending Accounts FSA A FSA is a spending account provided by your employer that can be used to pay for different types of eligible expenses.

You dont pay taxes on this money.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Navia Benefits Health Care Fsa

Flexible Spending Accounts Fsa State Employee Health Plan

Benefits Home Health Savings Account Flexile Spending Accounts Updated 10 2021

Flexible Spending Account Fsa Cigna

Covid 19 And Fsa News Updates Faqs Flexible Spending Accounts Fsa The City Of Portland Oregon

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Navia Benefits Limited Health Care Fsa

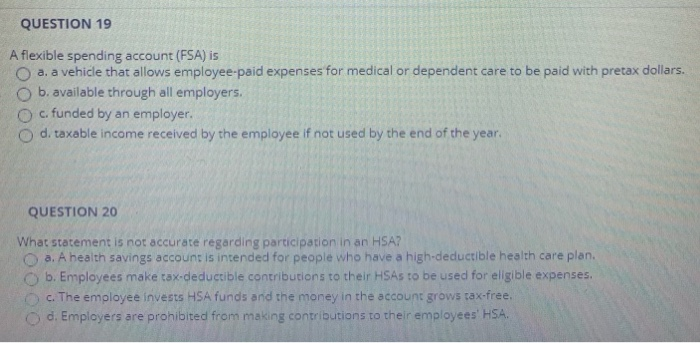

Solved Question 19 A Flexible Spending Account Fsa Is A A Chegg Com

Hra Vs Fsa See The Benefits Of Each Wex Inc

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Why Do Consumers Leave So Much Fsa And Hsa Money On The Table Visa

Hsa Vs Fsa How Does Your Health Plan Affect Your Taxes

Flexible Spending Accounts City Of Somerville

Health Fsa Flexible Spending Arrangement Plan Documents 129core Documents